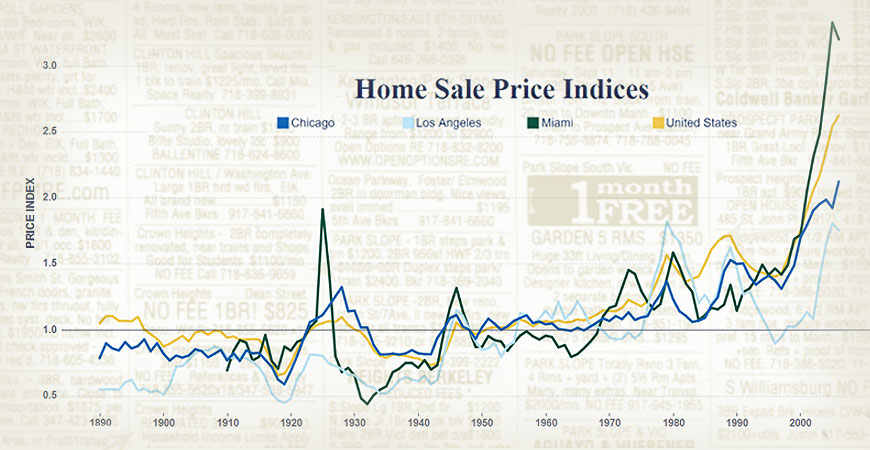

A groundbreaking database that tracks 13 decades of annual changes in U.S. home sales and rental prices provides a clearer picture of economic shifts through the 20th century and will be a valuable resource for homebuyers, housing policymakers and the real estate industry, a UC Merced researcher said.

Professor Rowena Gray teamed up with three other economists to develop the publicly available database, called the Historical Housing Prices Project (HHP). With a few clicks, anyone can create fever lines or bar charts of year-by-year price changes in the U.S. or in any of the 30 major cities the project targeted. For instance, users can compare home sales from 1930 to 1990 in San Francisco, Portland and Boston.

A paper that lays out the HHP’s methods and conclusions explains the data is drawn from 2.7 million listings in newspaper real estate sections from 30 major U.S. cities. The pages, originally saved on microfilm, were accessed at websites that digitally archived the microfilm.

Previous studies of U.S. housing prices and trends were pieced together with disparate and sometimes limited data sources. The HHP features a concise analysis of a consistent source of information. On top of that, the data spans 116 years, stretching from the invention of the pneumatic tire to the mapping of the human genome.

“Before now, we didn’t have a systematically collected annual dataset on rents and sales prices for this number of cities over such a long stretch of time,” said Gray, a faculty member in UC Merced’s Department of Economics and Business Management .

The dataset starts in 1890, when housing listings began to appear consistently in newspapers, and ends in 2006, when real estate pages began to vanish due to the incursion of online sites such as Craigslist.

Gray started working on housing data several years ago while on the faculty of the University of Essex. In 2018, she connected at a conference with Professor Ronan Lyons, who was doing similar research at Trinity College in Dublin, Ireland. Allison Shertzer, an economic adviser for the Federal Reserve Bank of Philadelphia, joined the project as a third principal investigator. Ph.D. candidate David Agorastos of the University of Pittsburgh completed the team. They secured a National Science Foundation grant to start work on what became the HHP, which the Philadelphia Fed hosts on its website.

Before now, we didn’t have a systematically collected annual dataset on rents and sales prices for this number of cities over such a long stretch of time.

The Quarterly Journal of Economics has invited the paper’s authors to resubmit an edited version for publication.

Some of the project’s insights:

Inflation-adjusted home prices tripled between World War I and the Great Recession of 2006. Previous measurements concluded prices had only doubled.

Rental prices rose over the same period, 20% higher in 2006 than in 1914 (again, adjusted for inflation). Earlier studies said rents fell by half from 1914 to 1948, then were largely unchanged through 2006.

Overall price inflation may have been stronger than previously estimated, rising 3.5% per year rather than 3.3%. That sounds like a small difference, but over several decades, it adds up.

Ronan expands on these points and several others in a smartly written Substack account about the HHP.

The project also examined the financial return on housing — profit from sales of residential property or the return on investment in rental properties. The latter, also known as rental yield, has fallen over time, while the former has soared.

“These vary substantially across cities,” Gray said. “For example, cities like Detroit have had a negative return on housing for many decades, while housing in coastal cities has been a good investment for a long time due to capital gains.”

The HHP can be a powerful tool in numerous contexts:

Real estate professionals can analyze historical trends to make informed decisions about investments and market strategies.

Researchers can use the data to study the role of housing in economic cycles, financial crises and long-term economic trends.

Potential homebuyers can gain insights into price trends in cities to make informed purchasing decisions. Similarly, property owners can see trends in housing prices and rents, helping guide decisions about selling or renting.

Policymakers can analyze the data to understand affordability trends and develop strategies for housing issues.

The project used about 50 people — graduate students, undergraduates and independent contractors — to cull through millions of newspaper listings. For a listing to be usable, it had to provide a price, the number of rooms, the property type (house or apartment) and a location within the city (such as Huntington Beach in the Los Angeles area).

“We're excited to put this out,” Gray said. “As an economic historian, I enjoy creating new datasets, and now we're at a point where we can make them publicly available.”